JON RITTER – RITTER MORTGAGE GROUP

Make the Right Home Financing Decision

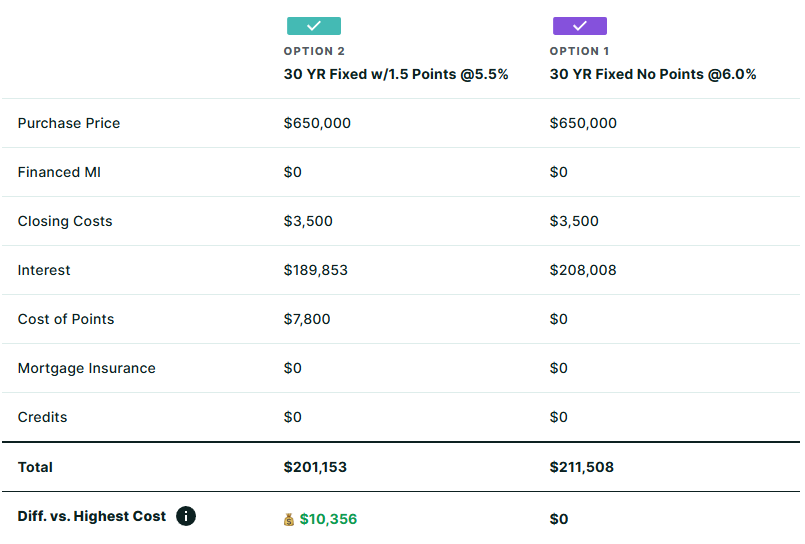

We help buyers and homeowners understand what mortgages actually cost — so the best loan type, structure and strategy are clear from the start.

View additional sample Decision Snapshots →

How we help

- As a mortgage brokerage, we work with a wide range of wholesale lenders who compete for your loan, resulting in better pricing and more flexible options than a single bank or credit union can provide.

- We always have competitive rates, but rate alone does not determine what you actually pay.

- Our aim is to develop the right loan strategy for your situation and present clear, bottom-line options that reduces your total cost.

People work with us when they:

- Are under contract or preparing for pre-approval and want to make confident financing decisions with expert guidance

- Want clear direction on loan options, strategy, timing, and total cost

- Want to stay informed and in control, with an experienced professional managing the details

Trusted by homeowners

Clients consistently rate us five stars because we focus on strategy and clarity, not pressure.

Why this approach works

- Many rates are available every day. What matters is what you pay to obtain a given rate, since total cost is often obscured in the pricing and loan structure.

- Our guidance is informed by real-time market conditions and lender pricing, leading to better loan structure and timing decisions.

- Our experience helps anticipate and navigate unexpected property and qualification issues that can arise even for well-qualified borrowers using conventional loans.

See real client case studies →

Still deciding whether now is the right time to buy?

See how buying now versus waiting could affect cost and opportunity in your area.

Request a Buy Now vs Wait Analysis →

For homebuyers considering timing

Loan types & strategies

- Conventional loans

- Jumbo loans

- FHA, VA & USDA loans

- Down payment assistance programs

- Self-employed & bank statement loans

- Investor & DSCR loans

- Reverse mortgages

Areas we serve

Based in Northern Maryland, serving DC, Pennsylvania, Northern Virginia, and select markets nationwide.

Still deciding?

Get a 1-Page Decision Snapshot

One page. One clear recommendation. No obligation.